The reality of college loans

Are student loans right for you? What does the future hold for higher education?

Many students, especially in our area, are encouraged to seek a bachelor’s degree that can land a stable job above minimum wage. Is the staggering price of the degree itself worth it? 6.7 percent of college graduates are unemployed, 35 percent cannot afford to pay rent and according to the Education Data Initiative “21% of borrowers see their total student loan debt balance increase in the first 5 years of their loan.”

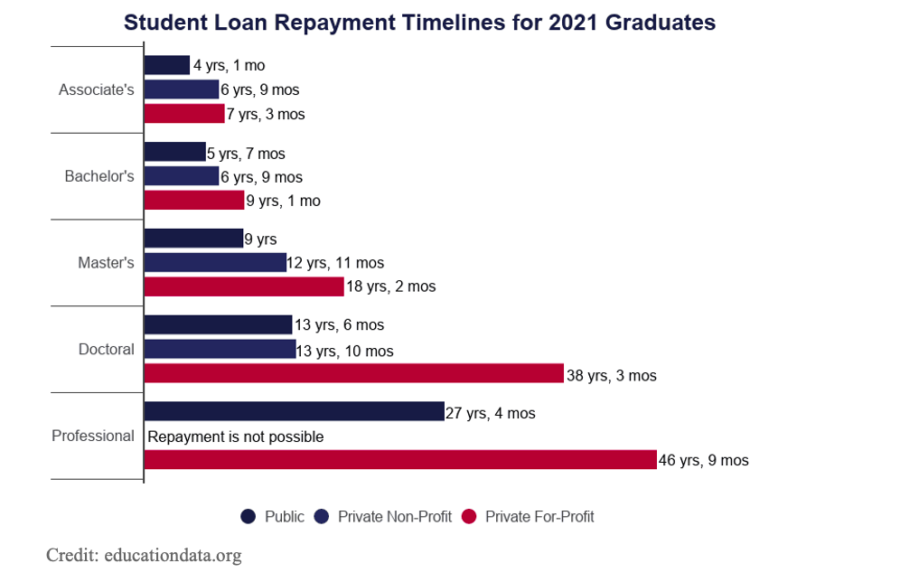

College is a hot topic, not only for seniors but for younger students and parents. College prices are extremely expensive, and it takes, on average, 20 years to pay off loans.

College is a big part of American life- 42 percent of Americans go to college every year. In past decades, college was only for the wealthy, upper class. Student loans were introduced during the time of the Vietnam war because many who could not afford college joined the army- and the war was not popular.

The government gave funding so that colleges could give out loans so that more people could get an education. However, this arrangement was not intended for middle class families- only for upper class and rich families. An influx of people, from all backgrounds, take advantage of loans in hopes of a better future.

Consider some factors that inflate the student loan crisis.

Unlike bank loans, just about anyone can take out a student loan. This makes college widely available- but does not ensure the borrower can pay back what they owe. Some colleges and universities take advantage of this and drive the price up- knowing that people will not shirk away from a hefty price tag for the “American Dream.”

Federal assistance with education has recently dropped. As a result, state budgets are tightening, giving state colleges less money to provide lower room, board, and tuition prices to their students. Grants have decreased in value so the benefits that are offered do not really aid students under the burden of their loan.

Higher education makes a profit off tuition, sports, federal or state aid, and interest on student loans. Colleges make the most profit off of middle class families because they often make too much to receive aid and not enough to pay it off on their own. A common tactic is for colleges to push families into committing to a loan that they could never pay off so they can pocket the proceedings.

The college industry is partly responsible for the student loan crisis. Some poor-quality colleges and universities have access to student loans. This means when a student takes out a loan for their education- but is unable to find a job due to its poor quality, the government is responsible for the funds and the colleges keep the money in their pocket.

As previously mentioned, many can take out student loans. This increases the demand for college degrees, and- you guessed it- student loans. With an increase of demand there is an increase in price. College can basically make you pay as much as they would like because there will not be any shortage of degree seekers anytime soon.

Recently, there is a trend for more and more job postings requiring a bachelor’s degree. The people who are currently retiring or leaving from these jobs never had a bachelor’s degree. Why the change? Degree inflation.

A degree is an easy indicator that the applicant is well versed in technology. This is important because there has been a shift- in almost every industry requiring more technology and social skills since many middle skill jobs have shifted to more technological ones. Middle skill jobs are ones that you need more than a high school diploma but less than a bachelor’s degree.

Some ways you can save:

The most important way to save yourself stress in the future is to do your research. Make sure if you are going to take out a loan the school you are going to will give you the high-quality education you expect.

Some people take jobs that they are overqualified for to pay off their debts right away. This defeats the purpose of your degree and sets you back. Fully take advantage of your degree to get your money’s worth.

While in college, every penny counts! Even small expenses like pizza or coffee can add up to thousands of dollars that you will have to pay back later with interest!

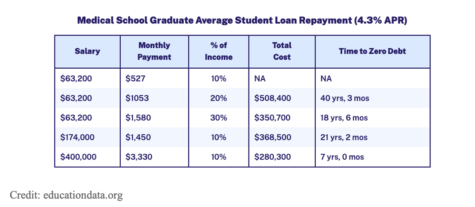

Do not underestimate the amount of debt you plan on undertaking. Plan how much you expect to make after graduation and how much debt is reasonable. If you borrow more than what you can afford, you can end up losing your license, your debt will increase, and a lender can withhold 15 percent of your paycheck. You should also investigate your loan policy and what would happen if you cannot pay back your student loans for some reason so that you are prepared for any worst-case scenario.

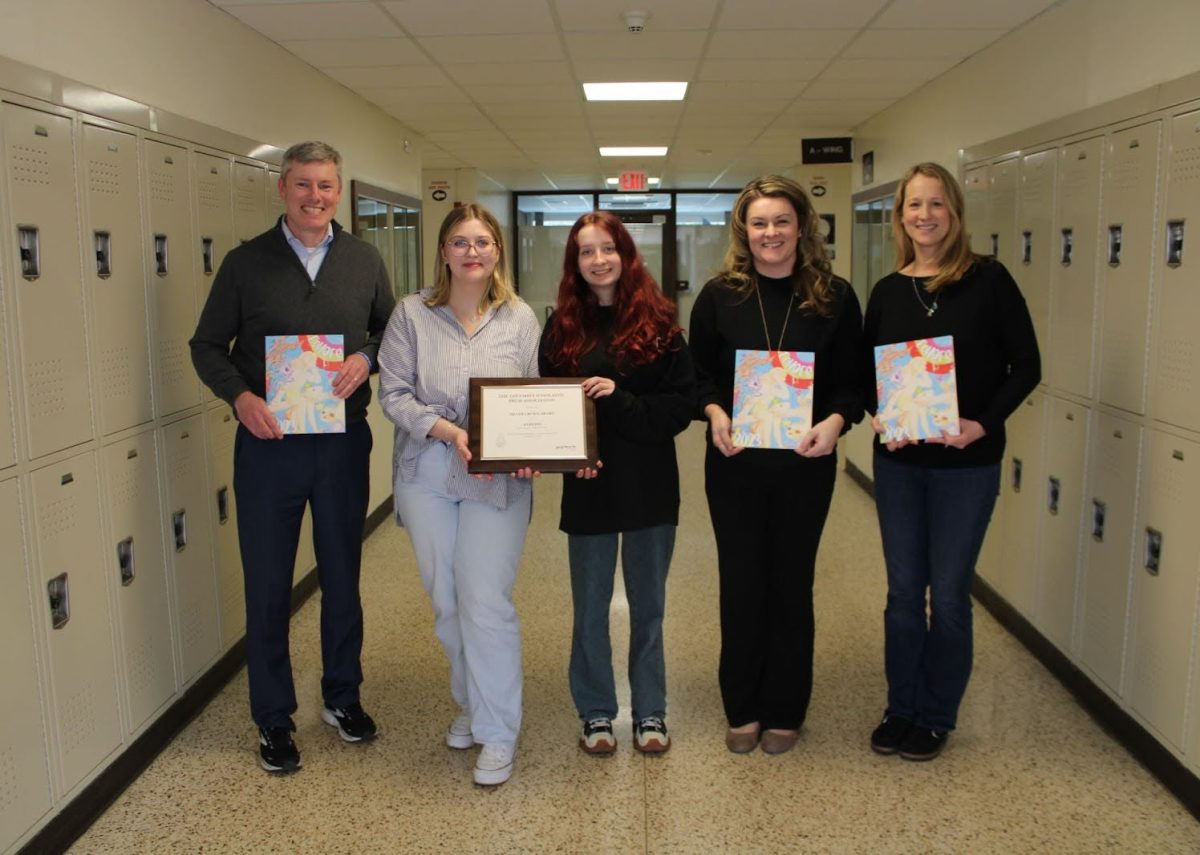

Steven Casemento, the Pascack Hills local counselor, about his opinions on student debt since he helps students prepare and apply for college. Consider some comments from Casemento:

Do you think that college debt negatively affects a student’s education?

“It does and it doesn’t if there is no return from the investment… Debt also gives people who don’t have a means.. gives them an opportunity… Allows [them to] develop credit… Shows that we’re a good borrower”

How has college debt/prices affected student’s view of college?

“I think it affects people’s view of college because they start to wonder if they need it. We talked about … ‘Well is it worth this amount of money for what I’m going for?” So in some ways it might devalue what education can be, in other ways I think that people see that it’s important sometimes things that are a lot of money or are worth it to to invest in.”

Do you think going to college is worth the possible risk?

“I do think just that is worth it because there are just some careers that you need more education on and having to do well at that. Do not feel it is important for everybody, know I think at the end of the day if you’re able to develop structure for yourself and be able to be a self learner you can certainly make it in this world without an additional education.

What do you think the future holds for the college industry and future students?

“That’s a really good question I think now a days or we could go to college to get a job so nowadays everything is job feel like you looked everywhere and people are starting their own businesses making their own crafts and you know buying the virtual Art Online right …that are appreciated in value, so when we think about the future I wonder if there is a more dynamic widespread of opportunity in college.”

“But I also think there might be more students who weigh the possibility of college not being necessary or at least not be necessary right away. College was my next step right after high school with kids nine years ago; kids are just like “Absolutely! So, I think twice about when the right time is to take advantage of that there’s no timeline in life oh for some students has like ‘I’d like to do I’m not ready for that yet if I want to make some things first something else first before I make an investment go to school.”

What are your thoughts on the college debt?

“I guess like I said before it is tough because I think in your past, I think about you know even my parents and when they went to college I guess, like I said before, it is tough because I think in your past, I think about you know, even my parents and when they went to college debt to income ratio is very different. …Regardless, the amount of debt-to-income ratio is very different, percentages of what my dad, say, owed on college was less than what he made. And I see that’s less and less common nowadays. College gets more expensive and maybe that’s not even keeping up with the increase in salary over time.”

“It is definitely something that’s a little bit more difficult, and I think has pushed back, you know, you’re the timeline of being able to, you know, get married or buy houses or finance a car or make big purchases earlier on in life. I think it’s … previous generations were able to do that earlier, and I think student loan debt really put a pause on that for some, maybe not all. At the end of the day, I think we’re a more educated world than we were before, which is always a good thing.”

What is your advice for students who want to undertake debt- but want to lessen it?

“I think the important thing is to make sure you’re doing your research look at you know the possibilities of your future careers and get an idea of ‘Well, what is my return on this investment?’ [Then] understanding that college is not a one-size-fits-all cost… There are some schools that are less than others and therefore if you know your best opportunity is to go to a school that is more affordable and maybe less prestigious just from like a date social or cultural standpoint, then that’s the best decision for you- and that does not make you less of a person.”